22 need direction for investing/financing.

#1

I'm 22 I make roughly 39-41k/yr which will continue to go up each year. Currently I live at home, have no debt, have a credit score of 740+, I do pay my parents 325/mo for rent. Besides the rent my out going expenses are car insurance/cell phone which together is around 200 a month. It's a bit hard for me to have a good budget worked out because of how seasonal my job is. For the months of april-june and september-november I make the bulk of my money working 70-100 hour weeks, the rest of the year I get around 30-40 hour weeks.(typically 30 so I have downtime after working so many hours.)

Anyway long story short,

I have an outgoing payment of roughly 525/mo currently.

I have no debt, 740+ credit score

I own 2 cars,

I have an IRA via my job/medical benefits.

where should I start investing my excess money?

I'm also in the market to start looking at houses, I just don't want to get tied down to that much of a commitment yet unless I just love the house. Any and all input welcome.

Anyway long story short,

I have an outgoing payment of roughly 525/mo currently.

I have no debt, 740+ credit score

I own 2 cars,

I have an IRA via my job/medical benefits.

where should I start investing my excess money?

I'm also in the market to start looking at houses, I just don't want to get tied down to that much of a commitment yet unless I just love the house. Any and all input welcome.

#2

Since you are young with no kids and such, save $1000 a month. In 1 year you will have $12,000 and in 10 years you will have $120,000 assuming 0% growth so you will probably have more than that.

Leverage your time because you are young and make excess cash every month and educate yourself on the power of compounding returns:

please read this article

http://www.adviceaboutfinance.com/20...d-you-are-set/

As for investments I will leave that for other people to chime in, but you have many options...

Let me know what you think

Leverage your time because you are young and make excess cash every month and educate yourself on the power of compounding returns:

please read this article

http://www.adviceaboutfinance.com/20...d-you-are-set/

As for investments I will leave that for other people to chime in, but you have many options...

Let me know what you think

#3

I'm 21 and I have had success with this company if you want to have your money work for you. It is also a way to compound your money.

www.s2kfan.zeekrewards.com

Give me a call 407-252-8101

Andrew

www.s2kfan.zeekrewards.com

Give me a call 407-252-8101

Andrew

#4

I'm 21 and I have had success with this company if you want to have your money work for you. It is also a way to compound your money.

www.s2kfan.zeekrewards.com

Give me a call 407-252-8101

Andrew

www.s2kfan.zeekrewards.com

Give me a call 407-252-8101

Andrew

I am familiar with this type of get rich scheme, only the top 2% make tons of money off the backs of the rest of the people trying to sell. Don't get caught in this, financially educate yourself and make better use of your time...

#6

Registered User

That's a really good way to describe it to people. Saving 1000 a month sounds so much easier when its put in that perspective.

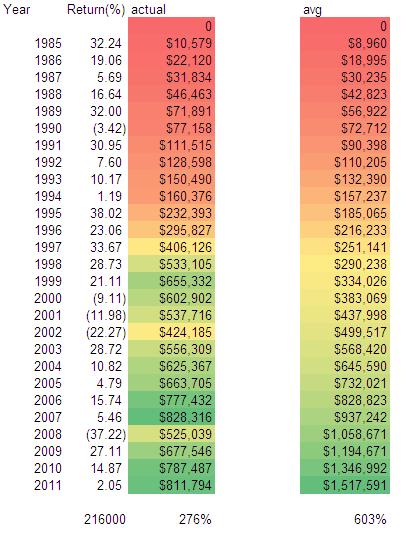

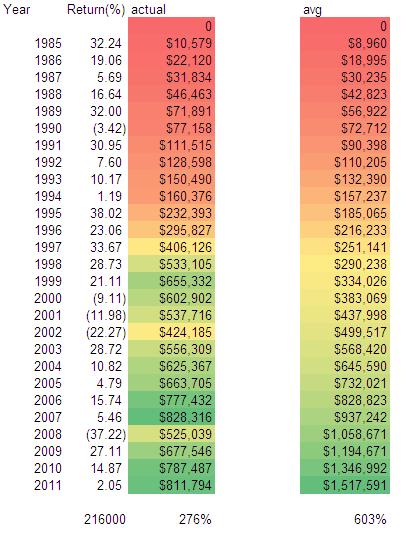

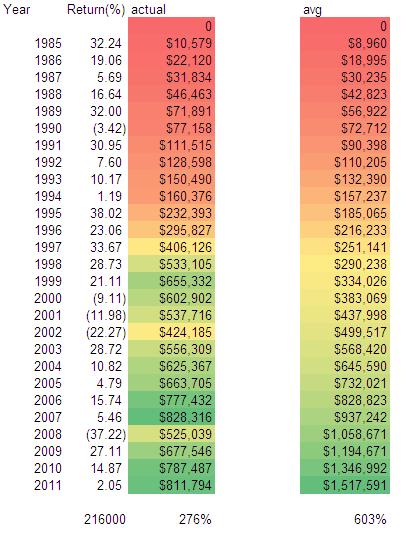

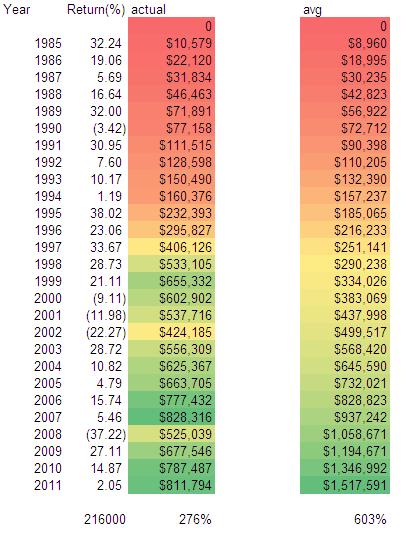

I had a comment on the article though, if anyone has any input. If you assume you save 8000/year, like in the article, but from 1985 to 2011 (i was born in 1985), and then use a compounding rate of 12% (avg return from 1985 to 2011 http://www.moneychimp.com/features/market_cagr.htm) you end up putting 216,000 of your own money in, but end up with 1.5mm, which is 6x the money you put in.

If you used the actual returns of the S&P500 by year from 1985 to 2011, it goes up and down wildly. As you can see in my pasted excel chart, you only end up with $811,000 if you use the actual returns. So averaging might give you an estimate but by using the actual returns you only end up with half of the returns you projected. So while it still proves a very valid point, isnt it a little misleading as to what your actual returns are? Or should it just be understood that this dispartity between estimated and actuals exists and looks this way and this example is just to prove the point?

I had a comment on the article though, if anyone has any input. If you assume you save 8000/year, like in the article, but from 1985 to 2011 (i was born in 1985), and then use a compounding rate of 12% (avg return from 1985 to 2011 http://www.moneychimp.com/features/market_cagr.htm) you end up putting 216,000 of your own money in, but end up with 1.5mm, which is 6x the money you put in.

If you used the actual returns of the S&P500 by year from 1985 to 2011, it goes up and down wildly. As you can see in my pasted excel chart, you only end up with $811,000 if you use the actual returns. So averaging might give you an estimate but by using the actual returns you only end up with half of the returns you projected. So while it still proves a very valid point, isnt it a little misleading as to what your actual returns are? Or should it just be understood that this dispartity between estimated and actuals exists and looks this way and this example is just to prove the point?

#7

That's a really good way to describe it to people. Saving 1000 a month sounds so much easier when its put in that perspective.

I had a comment on the article though, if anyone has any input. If you assume you save 8000/year, like in the article, but from 1985 to 2011 (i was born in 1985), and then use a compounding rate of 12% (avg return from 1985 to 2011 http://www.moneychimp.com/features/market_cagr.htm) you end up putting 216,000 of your own money in, but end up with 1.5mm, which is 6x the money you put in.

If you used the actual returns of the S&P500 by year from 1985 to 2011, it goes up and down wildly. As you can see in my pasted excel chart, you only end up with $811,000 if you use the actual returns. So averaging might give you an estimate but by using the actual returns you only end up with half of the returns you projected. So while it still proves a very valid point, isnt it a little misleading as to what your actual returns are? Or should it just be understood that this dispartity between estimated and actuals exists and looks this way and this example is just to prove the point?

I had a comment on the article though, if anyone has any input. If you assume you save 8000/year, like in the article, but from 1985 to 2011 (i was born in 1985), and then use a compounding rate of 12% (avg return from 1985 to 2011 http://www.moneychimp.com/features/market_cagr.htm) you end up putting 216,000 of your own money in, but end up with 1.5mm, which is 6x the money you put in.

If you used the actual returns of the S&P500 by year from 1985 to 2011, it goes up and down wildly. As you can see in my pasted excel chart, you only end up with $811,000 if you use the actual returns. So averaging might give you an estimate but by using the actual returns you only end up with half of the returns you projected. So while it still proves a very valid point, isnt it a little misleading as to what your actual returns are? Or should it just be understood that this dispartity between estimated and actuals exists and looks this way and this example is just to prove the point?

If you are 65 and your 401k is crushed, sorry, just bad timing. If you are young and are starting from this point, there are tons of cheap companies and plenty of opportunities. You bring up a point about the poor returns these past two decades....I cannot predict the future, but I know that once we get out of this recession, a lot of the bargains we see now will dissappear, and most people that were too scared to invest early would probably be kicking themselves and asking why the didnt...

Trending Topics

#8

Originally Posted by ANDREW91' timestamp='1339293884' post='21769241

I'm 21 and I have had success with this company if you want to have your money work for you. It is also a way to compound your money.

www.s2kfan.zeekrewards.com

Give me a call 407-252-8101

Andrew

www.s2kfan.zeekrewards.com

Give me a call 407-252-8101

Andrew

I am familiar with this type of get rich scheme, only the top 2% make tons of money off the backs of the rest of the people trying to sell. Don't get caught in this, financially educate yourself and make better use of your time...

#9

Registered User

lol i didnt realize you were the author of that post. well done

I also was looking at it further and the giant 37% loss in 2008 crushed a lot of the big gains towards the end of the investment period. before that, in 2007 the left column was in the 800k range while the right column was in the 900's not so far off. the 37% absolutely demolished a lot of those gains and it had to start back up.

maybe if you are slightly more savvy than just investing in the SP500, if you change those negatives to at least 0, then it wouldnt be so bad.

Edit: in the left column, if i change any losing year to a 0, you come at an 831% profit, quite a bit higher than 276 if you were completely passive and just invested in the SP500.

I also was looking at it further and the giant 37% loss in 2008 crushed a lot of the big gains towards the end of the investment period. before that, in 2007 the left column was in the 800k range while the right column was in the 900's not so far off. the 37% absolutely demolished a lot of those gains and it had to start back up.

maybe if you are slightly more savvy than just investing in the SP500, if you change those negatives to at least 0, then it wouldnt be so bad.

Edit: in the left column, if i change any losing year to a 0, you come at an 831% profit, quite a bit higher than 276 if you were completely passive and just invested in the SP500.

#10

I have had some people come up to me to try to do that affiliate marketing thing, I see it as a waste of time. I would rather use that time to financially educate myself in stocks, real estate, oil and gas llp, ect... call me old fashion. Anyway, I make some money through affiliate marketing, but I have created my own system, check out my blog in the signature. I would rather create my own system, than join a pyramid scheme. Lol, you wanna join my affiliate marketing network? jk jk

patientcashflow.com

patientcashflow.com